Engaging in real estate ownership and investment is my profession, representing a highly lucrative and empowering opportunity. Nevertheless, it is crucial to understand the principles of wealth building to avoid the common pitfall of believing one is generating profit while, in reality, experiencing financial losses.

Acquiring properties at a low price and subsequently selling them at a higher price can indeed generate substantial financial returns; however, this approach does not constitute true wealth building. Allow me to elucidate this concept using real-life examples and data from the Toronto and Greater Toronto Area (GTA) real estate market.

Let’s dig in

What if I suggest that accumulating wealth through real estate cannot be achieved by purchasing properties outright with cash? Instead, it is essential to leverage real estate effectively for optimal financial growth.

To accumulate wealth, individuals must enhance the real value of their assets at a rate that exceeds the growth of the national money supply, as this growth results in currency devaluation or debasement.

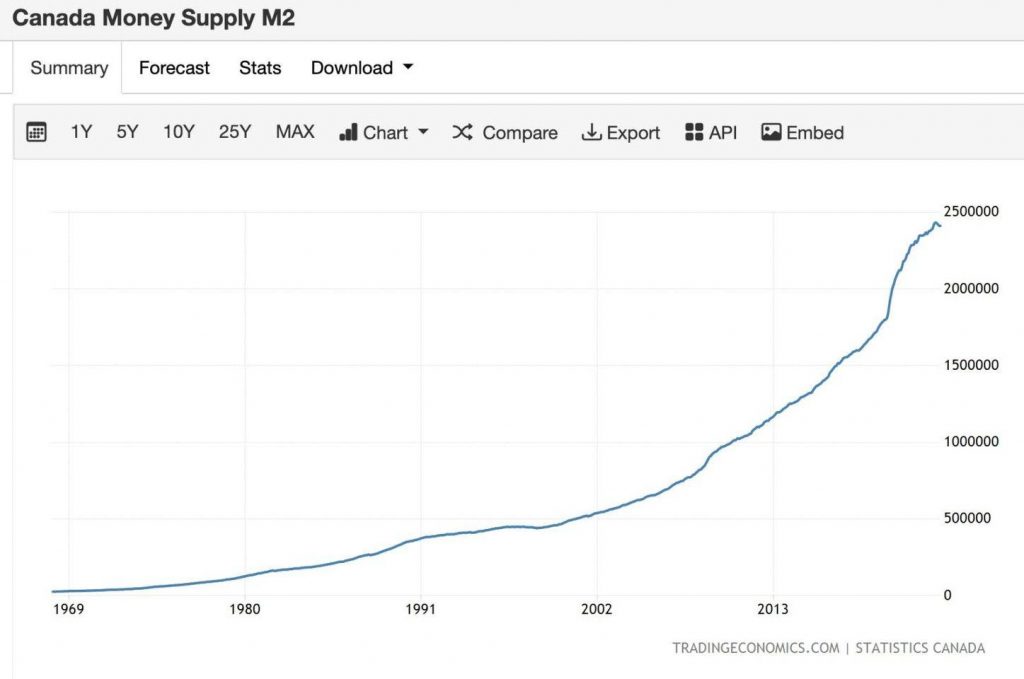

Canada’s money supply or M2 is Shown Below:

M1 includes money in circulation plus checkable deposits in banks. M2 includes M1 plus savings deposits (less than $100,000) and money market mutual funds.

Since the year 2000, there has been a significant fivefold increase (5x), in contrast to the average growth rate of 8.1% observed from 1968 to 2024. This notable rise reflects substantial changes during this period.

The money supply in Canada is expanding at a rate that exceeds both the growth of real estate prices and the accumulation of individual wealth. Consequently, there has been a noticeable decline in purchasing power.

The devaluation of currency is occurring at a more rapid pace than individuals are able to achieve financial gains. This phenomenon contributes to the widespread perception that many individuals are not making progress in their economic circumstances.

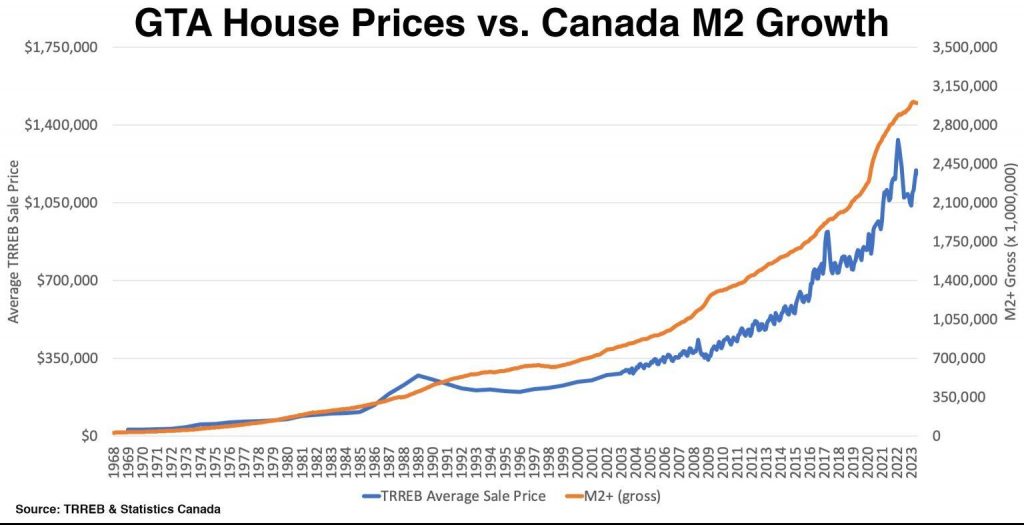

Let us analyze the chart that depicts the appreciation of average house prices in the Greater Toronto Area (GTA), represented in blue, alongside the increase in the money supply in the economy, represented in yellow, from 1968 to 2024.

Canada’s M2 money supply mapped against Toronto/GTA property prices:

Look at the reality through numbers.

Ave annual GTA Real Estate Price Appreciation since 1968 to 2024 = 7%

Ave Annual Money Supply (M2) Increased since 1968-2024 = 8.1%

Annual Average Net Loss of Wealth by Owning a Paid-off Home = 1.1%

(Between 1968 and 2023, the average property prices in the Greater Toronto Area (GTA) have appreciated by approximately 7% annually. However, during the same period, the money supply increased at an average annual rate of 8.1%. This discrepancy has resulted in an average annual loss of wealth for homeowners of at least 1.1% since 1968.)

The decline in wealth or assets primarily impacts individuals who have made cash purchases or who possess homes that are entirely paid off.

Who Gets Wealthy in Owning Real Estate in Toronto?

- When you buy with a Mortgage – Get Wealthy by $ 53,800

Homeowners who leverage their assets five times or more are the true winners, and it is imperative to build wealth by purchasing properties with borrowed money.

Assume you bought a Property for $ 1,000,000 with a 20% down payment and the Property appreciates at an average of 7% a year while the Canadian Money supply Increases by 8.1%

- You gained $ 70,000 in Appreciation

- You invested $ 200,000 and Borrowed $800,000 ( You leveraged 5 Fold)

- Your return /ROI = 35% (70k/200k)

- Your Return or Wealth building is at least 4 times greater than the Loss of value (8.1%) of the Canadian dollar due to Money Supply/debasement. ($81,000)

- You grew your wealth by 26.9% = $ 53,800

When you own a fully paid House = Decreased wealth by $ 11,000

Assume you have a fully paid home with no mortgage on it.

- House Value appreciated by $70,000 in a year for the Home that is valued at $ 1,000.000

- The value of the Canadian Doller lost 8.1% of its Purchasing power = $ -81,000

- Decrease of Wealth for the year owning a paid-off home =$ 11,000 (-81k – 70k)

This indicates that homeowners and investors can build wealth more effectively by owning properties that are financed with mortgages. That’s why prudent investors often refinance their homes and invest in multiple properties for themselves and their children.

Real estate is a powerful avenue for creating lasting generational wealth, and we are here to support you every step of the way.

Riyaz Rauf – A House SOLD Name

Sales Representative – Century 21 Innovative Realty Inc. Team Lead – A House SOLD Name Team & Condo Super Star Team

Mobile : 647.283.1966 | Office : 647.302.2144

I recommend consulting qualified financial advisors for professional financial advice.